Market Decode: How bonds work — and what they can do for you

Watch this video to get the basics on this key ingredient in a well-diversified portfolio

GENERALLY CONSIDERED THE MORE BORING, conservative part of an investor’s portfolio, bonds typically don’t get as much press as stocks do. And because they function differently from stocks and come in so many different flavors—Treasurys, municipals, corporate, high yield, etc. — they can be confusing. In the video above, Matthew Diczok, head of fixed income strategy for the Chief Investment Office for Merrill and Bank of America Private Bank, offers a clear, simple explanation of how bonds work and why they should be considered an important part of an investor’s strategy.

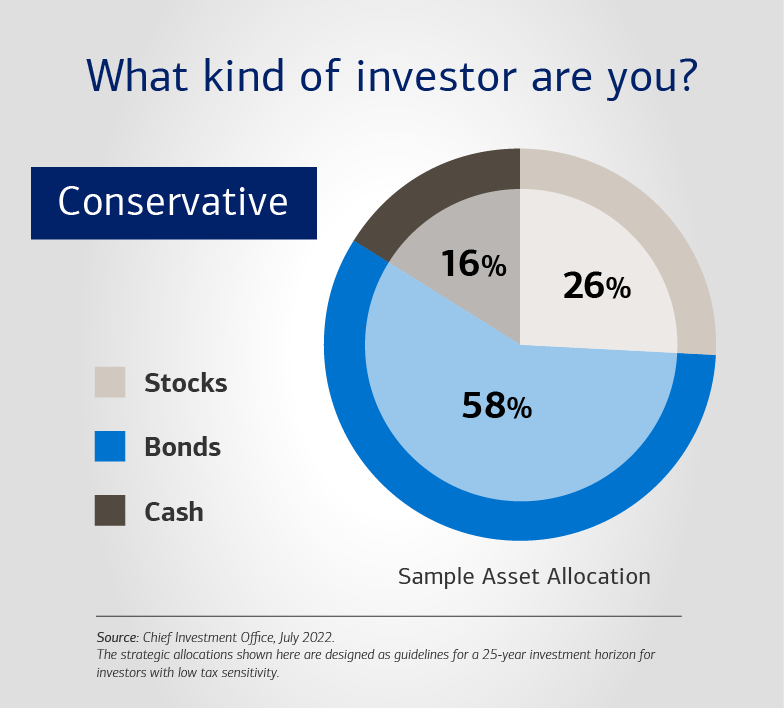

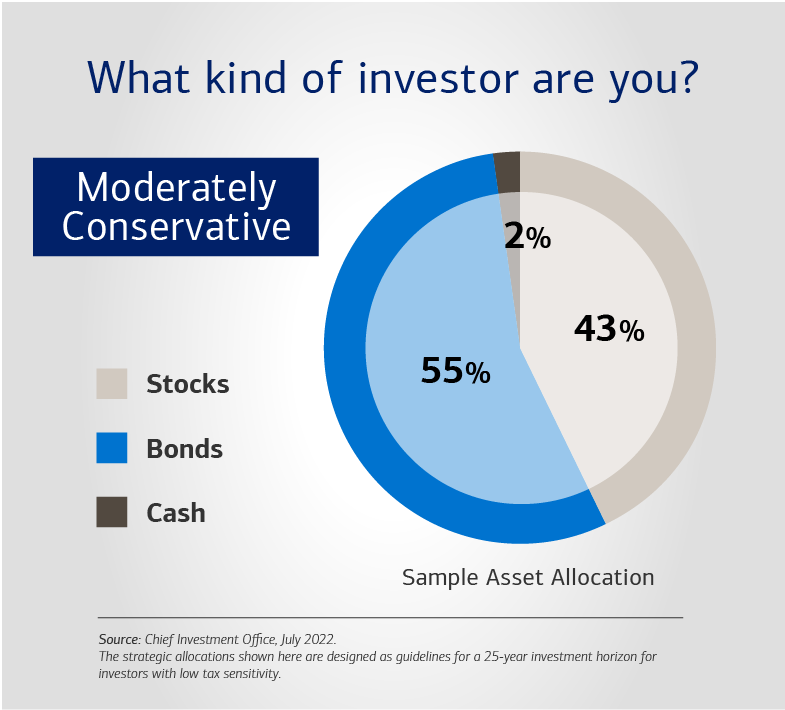

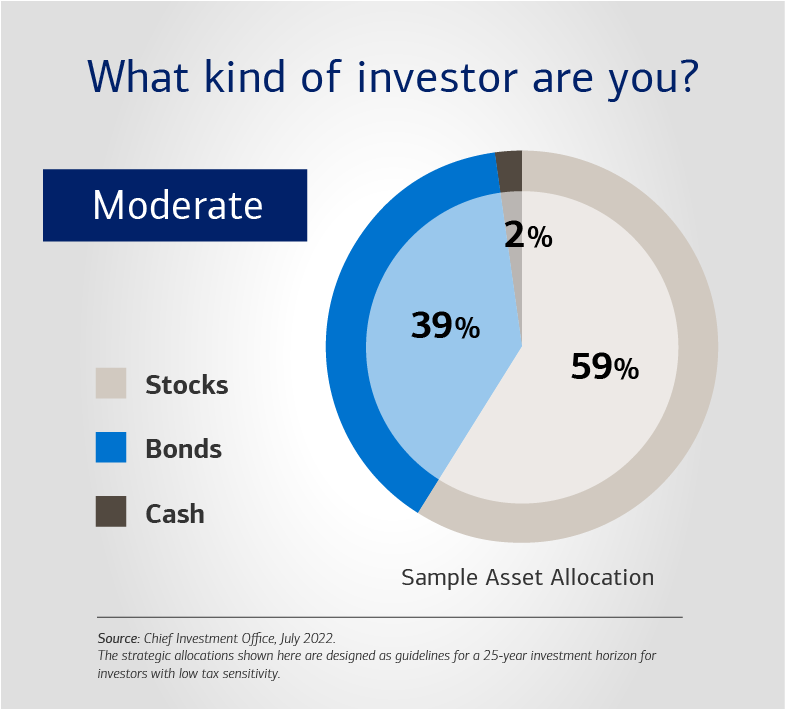

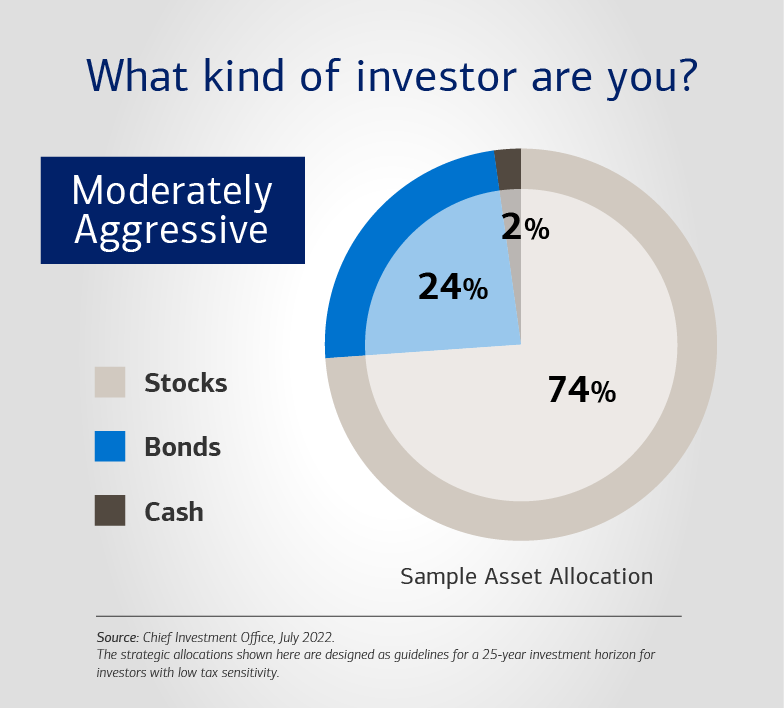

A well-diversified portfolio should include a mix of stocks, bonds and cash.

A well-diversified portfolio should include a mix of stocks, bonds and cash (the three major asset classes). How much of each you hold depends on your financial goals, risk tolerance, time horizon and liquidity, or cash, needs. When it comes to bonds (also referred to as fixed income), there’s a general rule of thumb: The more conservative you are as an investor, the more bonds you may want to own, relative to stocks (also known as equities). If you’re willing to accept a greater amount of risk — and have a longer time horizon to reach your investment goals — you may be more comfortable with stocks than with bonds.

Watch our video and then check out our slideshow below to find an appropriate asset allocation based on the type of investor you are. And be sure to speak with your financial advisor about any adjustments you might want to make to your long-term financial strategy

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Bank of America, Merrill or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

A private wealth advisor can help you get started.

Important Disclosures

Investing involves risk, including the possible loss of principal. Past performance is no guarantee of future results.

This material does not take into account a client’s particular investment objectives, financial situations or needs and is not intended as a recommendation, offer or solicitation for the purchase or sale of any security or investment strategy. Merrill offers a broad range of brokerage, investment advisory (including financial planning) and other services. There are important differences between brokerage and investment advisory services, including the type of advice and assistance provided, the fees charged, and the rights and obligations of the parties. It is important to understand the differences, particularly when determining which service or services to select. For more information about these services and their differences, speak with your Merrill financial advisor.

Bank of America, Merrill, their affiliates, and advisors do not provide legal, tax, or accounting advice. Clients should consult their legal and/or tax advisors before making any financial decisions.

This information should not be construed as investment advice and is subject to change. It is provided for informational purposes only and is not intended to be either a specific offer by Bank of America, Merrill or any affiliate to sell or provide, or a specific invitation for a consumer to apply for, any particular retail financial product or service that may be available.

The Chief Investment Office (CIO) provides thought leadership on wealth management, investment strategy and global markets; portfolio management solutions; due diligence; and solutions oversight and data analytics. CIO viewpoints are developed for Bank of America Private Bank, a division of Bank of America, N.A., (“Bank of America”) and Merrill Lynch, Pierce, Fenner & Smith Incorporated (“MLPF&S” or “Merrill”), a registered broker-dealer, registered investment adviser and a wholly owned subsidiary of Bank of America Corporation (“BofA Corp.”).

All recommendations must be considered in the context of an individual investor’s goals, time horizon, liquidity needs and risk tolerance. Not all recommendations will be in the best interest of all investors.

Asset allocation, diversification and rebalancing do not ensure a profit or protect against loss in declining markets.

Investments have varying degrees of risk. Some of the risks involved with equity securities include the possibility that the value of the stocks may fluctuate in response to events specific to the companies or markets, as well as economic, political or social events in the U.S. or abroad. Bonds are subject to interest rate, inflation and credit risks. Treasury bills are less volatile than longer-term fixed income securities and are guaranteed as to timely payment of principal and interest by the U.S. government. Investments in foreign securities (including ADRs) involve special risks, including foreign currency risk and the possibility of substantial volatility due to adverse political, economic or other developments. These risks are magnified for investments made in emerging markets. Investments in a certain industry or sector may pose additional risk due to lack of diversification and sector concentration. Investments in real estate securities can be subject to fluctuations in the value of the underlying properties, the effect of economic conditions on real estate values, changes in interest rates, and risk related to renting properties, such as rental defaults. There are special risks associated with an investment in commodities, including market price fluctuations, regulatory changes, interest rate changes, credit risk, economic changes and the impact of adverse political or financial factors.